The decarbonization of energy, a key objective of the fight against global warming and in particular of the European « Green Deal » proposed by the European Commission (EC) on July 2021, to achieve carbon neutrality in 2050, will lead to the implementation of an energy system where « clean » energies, produced without emitting CO2, would play a major role, in particular the electricity production (with nuclear, hydraulics, solar and wind power sources). Meanwhile some of those sources, in particular the last two, will use minerals described as « critical », and it is thus useful to recall the issues at stake because they are, in a way, the « hidden face » of renewable energies.

In a report on Europe’s strategic dependencies (Strategic dependencies and capacities, May 2021), the EC highlighted its vulnerabilities in a number of areas with regard to technologies and raw materials that are essential to its economy and energy infrastructures. Some of the minerals they use (lithium for electric batteries in particular) are produced by a limited number of countries which are often in a monopoly position and they are thus qualified as critical or strategic (Guillaume Pitron in his book, La guerre des métaux rares, Les Liens qui libèrent, 2018, had already remarkably highlighted this issue) and the EC stresses the need to assess the critical nature of several materials and to highlight its consequences. The EC, in conjunction with the JRC, had already carried out an initial assessment of the role of these materials in 2020 (Joint Research Center, Critical materials for strategic technologies and sectors in the EU, a foresight study, 2020, cf. P.Papon, Futuribles Vigie, 13 January 2021, www.futuribles.com ).

The manufacture of most of the heavy and light components of energy systems requires materials (metals, metalloids, carbon compounds), some of which are described as critical because they are either rare or produced by a limited number of countries and this report assesses the situation of technologies for which there will be major material supply problems in Europe. In particular, it reviews the material needs (26 in total) of three sectors considered as « strategic » (renewable energies, electric mobility, defense and aerospace). Lithium-ion batteries, fuel cells, wind turbines, motors for electric traction, and photovoltaic solar panels are put under the microscope: how critical are they (abundance and « safety » of the resource)? How will demand evolve? For example, the lithium-ion batteries that equip the vast majority of electric cars use a dozen or so materials which, in addition to lithium, graphite (in the anodes), cobalt (in the cathodes), and possibly titanium, silicon and niobium are considered critical, although manganese and nickel could be used in new anodes.

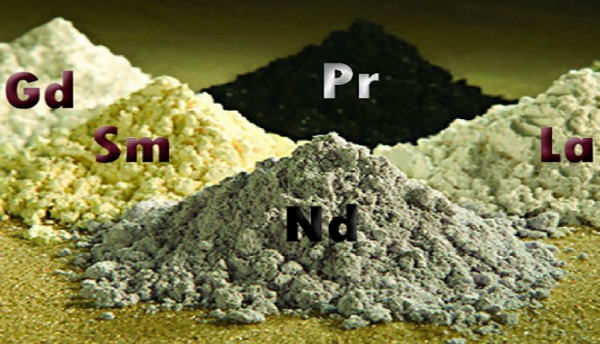

Criticality will be all the more important as demand will grow strongly (one scenario forecasts strong growth in the number of electric cars in the world: 230 million vehicles in 2050) and as Europe is currently in a weak position in terms of battery production: China provides 66% of it and the EU around 1% (but has launched several industrial projects), with China, Africa and South America providing 74% of the raw materials needed to manufacture them. Wind turbines are another case in point. Indeed, rare earths (neodymium and dysprosium in particular) and boron are important components of turbine magnets (neodymium-iron-boron alloys), and some fifteen metals make up the blades and mast of wind turbines; rare earths are considered critical metals because China has a virtual monopoly on their production (but not on reserves). The EU plays an important role, however, in the assembly stage of wind turbines. A third example is fuel cells (using hydrogen), in which platinum and palladium are used as catalysts in the electrodes, with South Africa providing 70% of the world’s platinum production (around 180 tonnes/year). According to the EC, demand for lithium and cobalt for all technologies would triple between 2030 and 2050, and double for dysprosium and neodymium.

At the political level, the EU experts recommend a special effort on batteries to reduce the EU’s heavy dependence on imports from Asia, particularly China, and on the production of infrastructure for the solar photovoltaic industry. Most of these materials are pillars of the energy transition, and the EU’s dependence on external resources for the most critical of them (rare earths, borates, cobalt, graphite, germanium, niobium, magnesium and platinoids) is high (with regard to China for rare earths, and the DRC for cobalt, in particular). This list is not new and, in France, the BRGM (a public office for geological survey and mineral resources) and the Committee for Strategic Metals (COMES) use regularly publishing one. It is surprising that copper, a key metal for electrical technologies, is not considered « critical », as are silver and gold.

The International Energy Agency (IEA) recently published a report that complements that of the EC (IEA, The role of critical minerals in clean energy transitions, May 2021, www.iea.org ). It assumes that the production of clean energy will accelerate (the installed capacity of wind and solar photovoltaic systems will triple by 2040 and sales of electric cars will increase by a factor of 25) and, noting that since 2010 the demand for critical minerals has increased by 50%, it will « explode » by 2040. The high geographical concentration of the production of minerals and of the metals extracted from them (China dominating the production of rare earths) will pose the problem of security of supply. The IEA reviews the demand for nine groups of metals used in energy industries and equipment (notably batteries). In its most voluntarist scenario, global demand would quadruple, and would be dominated by copper (used in power lines and motors), graphite and nickel. Demand for lithium would increase 42-fold, cobalt and nickel 21-fold, and rare earths for permanent magnets in wind turbines and electric motors (especially neodymium) 7-fold. The growth of the hydrogen energy vector, produced by water electrolysis, would lead to a strong demand for platinum, zirconium and nickel for electrolysers. Neither nuclear nor bioenergy are major consumers of critical metals, while solar photovoltaics are very demanding in terms of aluminum and copper. Technical breakthroughs would change the situation: new solar cells that do not use silicon but perovskites (compounds of lead or tin, see D. Lincot « La pérovskite donne un solide avantage au solaire », futuribles, April-June 2021, p.122), or cadmium and gallium, would shift the demand, while the replacement of permanent magnets by electromagnets would decrease neodymium demand.

The IEA estimates that metal ore reserves can meet demand, but their concentration would decrease (this is already the case for copper and lithium), so an increase in production costs is likely (with higher energy consumption) unless new metallurgical processes increase extraction yields and metal recycling makes progress (currently it is very limited for rare earths). The geographical concentration of production poses a problem: like the EC, the IEA notes the dominant positions of China for the production of rare earths, of the Congo (DRC) for cobalt, Australia and Chile playing a key role for lithium, Indonesia and the Philippines being leaders for nickel (but with significant production from New Caledonia), Latin America (Chile in particular), the Congo and China dominating the copper market and South Africa that of platinum. Finally, the IEA questions the « sustainability » of the exploitation of these minerals, which have a significant impact on the environment: use of large volumes of water in regions subject to water stress (in Chile in particular), air and water pollution, and significant waste disposals. Finally, working conditions on mining sites are often very harsh, sometimes even involving child labor.

The EU’s « green pact » as well as the national strategies for energy transition have not yet taken into account the new geopolitical situation that will be created by the rise of renewable energies: access to « critical » materials (the list proposed by the IEA is more comprehensive than that of the EC) will be a major geopolitical issue, and the risks of market domination by producers such as China (which has limited its exports of rare earths for several years) cannot be ignored. The « zero carbon » strategy requires: the programming of investments to guarantee the security of supplies, a policy of promoting technical innovations, particularly in metallurgy and metals recycling. It also implies a European mining strategy through participation in mining companies outside Europe (France has a card to play with nickel from New Caledonia…). Otherwise, Europe’s Green Deal will be exposed to major setbacks.